Grant Thornton leads sale of Cambridge-based Life Sciences consultancy

The Grant Thornton team revealed it has been working closely with the shareholders and leadership team since 2020 to develop a transaction strategy

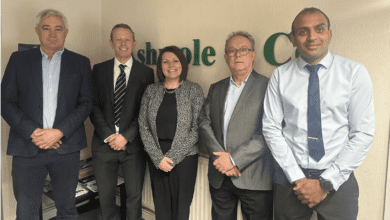

Grant Thornton UK’s Corporate Finance team in Cambridge has advised market access consulting provider MAP Patient Access on the sale of a majority stake to private equity investor Kester Capital for an undisclosed sum.

Founded by Christian and Dawn Hill, MAP is a provider of market access consulting services to the pharmaceutical and biotech sectors, with expertise in rare and orphan diseases and cell and gene therapies.

MAP has supported more than 70% of all Highly Specialised Technology Evaluations by the National Institute of Health and Care Excellence (NICE) to date and supported the development of 200+ new Health Technology Assessments and pricing submissions.

The significant investment, which is Kester’s fifth in the Life Sciences sector, will be used to accelerate the growth of the MAP Platform through broadening its services, expansion into new markets and targeted acquisitions.

The Grant Thornton team revealed it has been working closely with the shareholders and leadership team since 2020 to develop a transaction strategy, before identifying Kester Capital as the ideal partner to support MAP’s growth aspirations.

Doug Bentley, partner at Grant Thornton UK LLP, said: “MAP is a high-quality consultancy with deep expertise across orphan and ultra orphan diseases and cell and gene therapies. The strong cultural and strategic alignment with Kester will help the business to deliver its ambitious growth plans.”

The news follows a positive 2022 where Grant Thornton UK LLP’s East of England Corporate Finance team ranked as the second most active dealmaker in the Experian’s M&A adviser league table, completing 31 deals.

Christian Hill, founder of MAP Life Sciences, added: “Doug and his team at Grant Thornton held our hands at all stages of the transaction, which was important as this was our first such transaction. We are excited to be working with Kester to help further achieve our vision.”