Moore Kingston Smith advises 2i Testing on majority stake sale

This project involved reviewing the business strategy, financial reporting and key stakeholder engagement to develop a ‘comprehensive’ strategic growth plan.

Moore Kingston Smith has advised 2i Testing on a majority stake sale to Rockpool Investments.

2i Testing provides engineering services that de-risk its customers’ digital transformation.

The company plays a “key” role in the long-term development of mission-critical IT systems, with “highly skilled” software engineers and automation products for its public sector and blue-chip client base.

Rockpool Investments is a private equity firm dedicated to finding opportunities for individuals to invest in private companies. It provides funding from £5m to £15m for profitable UK-based private companies and has invested over £650m since inception.

2i initially engaged with Moore Kingston Smith Corporate Finance in 2020 to provide strategic growth advisory services, with a view to understanding the steps required to become one of the UK’s largest independent test consultancies.

This project involved reviewing the business strategy, financial reporting and key stakeholder engagement to develop a “comprehensive” strategic growth plan.

Following this, and with 2i’s operational and financial performance, the business sought further advice from Moore Kingston Smith Corporate Finance in finding a strategic partner to accelerate business growth.

After discussing 2i’s strategic objectives, it was clear that a private equity transaction represented the “best solution”.

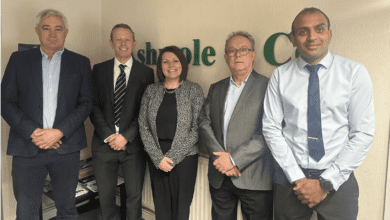

Moore Kingston Smith’s Corporate Finance team included Paul Winterflood, Matt McRae and Nathalie Strauss, who ran a competitive process to source the optimal partner for 2i.

Eventual investor, Rockpool, was 2i’s preferred bidder due to its focused vision for the post-transaction growth strategy and demonstrable expertise in facilitating buys and builds.

After accepting Rockpool’s offer, Moore Kingston Smith Corporate Finance negotiated comprehensive Heads of Terms which formed the basis of the key commercial elements of the SPA and equity documents, ensuring a smooth and efficient path to completion.

The group also helped 2i navigate a thorough due diligence process ensuring that the deal agreed in the Heads of Terms was successfully delivered in full.

Melanie Reed and Amy Tilley of Moore Kingston Smith’s Corporate Tax team advised across all aspects of the transaction structuring.

Paul Winterflood, Corporate Finance partner at Moore Kingston Smith, said: “Rockpool’s investment in 2i is a fantastic partnership for all concerned. It’s been a pleasure to work with Dave and the team on this transaction and I look forward to following 2i as they go from strength to strength in the next stage of their growth journey with Rockpool’s support.”