DSW Capital debuts on stock market

The group said its model is ‘increasingly attractive’ to professionals who are looking for an alternative to the Big Four

DSW Capital, a profitable, fast growing, mid-market, challenger professional services network, has announced its debut on the London Stock Exchange after raising £5m in an IPO on AIM.

The group, which owns the Dow Schofield Watts brand, said it has a cash generative business model as well as a scalable platform for growth.

It was originally established in 2002 by three KPMG alumni, and claims to be one of the first platform models disrupting the traditional model of accounting professional services firms.

DSW currently operates licensing arrangements with 19 licensee businesses with 82 fee earners across six offices in England and one in Scotland. These trade primarily under the Dow Schofield Watts brand.

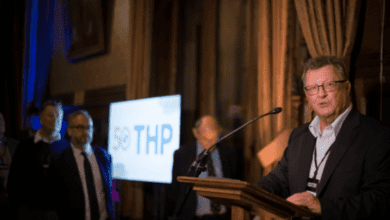

James Dow, CEO of DSW Capital, said: “Joining AIM today is a momentous occasion for the whole of the DSW team and our stakeholders. It will allow us to invest more readily in the expansion of our Network and assist us in realising our vision to become the most sought-after destination for ambitious, entrepreneurial professionals to start and develop their own businesses.

“The UK accountancy marketplace is changing rapidly. An increasingly onerous regulatory environment, combined with the desire for lifestyle change driven by COVID-19, is a heady mix, which makes DSW’s model increasingly attractive to ambitious professionals, who want autonomy, equality and opportunity and are seeking an alternative to the Big Four.”

He added: “We look forward to life on the public markets, to the opportunities that brings for all our licensees, partners and employees, and to reporting on our progress, as we continue to challenge the traditional marketplace for professional services in the UK.”