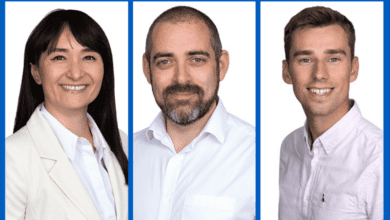

DLA Piper appoints new financial regulation partner

Hainsworth has advised a wide range of financial market participants on financial markets and financial regulatory issues for over 15 years

DLA Piper has strengthened its financial regulation practice with the hire of Antony Hainsworth as the firm’s new partner in its London office, effective from 1 July 2022.

Previously, Hainsworth was the UK head of Financial Services Regulation at Societe Generale since 2015, and became a managing director in 2018. He began his career in private practice, as part of a leading Magic Circle regulatory team, before moving in-house to another international bank in January 2011.

For over 15 years, Hainsworth has advised a wide range of financial market participants on financial markets and financial regulatory issues.

He has a particular focus on the challenges faced by international firms in managing their supervisory relationships, the use of trading venues, CCPs and other market infrastructure, managing conflicts between international rules, and designing and implementing governance and operational frameworks.

Tony Katz, global co-chair of DLA Piper’s Financial Services sector team, said: “We are delighted to welcome Antony, a true industry expert, to boost our UK and international regulatory expertise.

“Antony’s wealth of regulatory experience, and depth of knowledge of financial markets, will be a great asset to DLA Piper and our banking and other financial services clients, who strive for practical and pragmatic advice.”

Hainsworth added: “I am delighted to be joining. DLA Piper puts clients at the heart of its offering, and with its unrivalled global platform the firm has real capability to assist clients in navigating financial regulations wherever they do business.

“Whilst financial regulation is often complex, practical solutions shouldn’t be. I am very pleased to return to private practice and look forward to helping a range of clients build the most competitive, compliant businesses possible.”