Haines Watts launches new capital allowances arm

It has appointed David Holroyd to take up the position of director in the team

Haines Watts has bolstered its tax incentives and reliefs service line with a newly launched capital allowances offering.

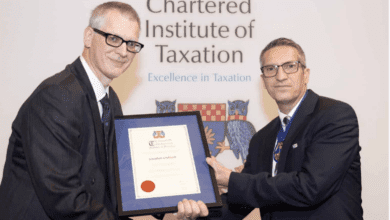

The team will be headed up by David Holroyd who joins Haines Watts as a director. With over 35 years’ experience exclusively providing capital allowances consulting services, the firm said he holds an “enviable reputation” with businesses and professional advisors.

He will be joining Jonathan Scott, Tax partner, and Mario Minchella and Sam Moore, Tax Incentives and Reliefs managers, who already work alongside some of the region’s most well-known names in construction and property.

Speaking on the growth of the team, Scott said: “Whilst most businesses and accountants will be aware of capital allowances in general terms, it requires a different exercise and skillset to survey qualifying assets and truly maximise the value of a claim – especially when claiming relief for commercial property.

“Our new multi-disciplinary team combines a deep knowledge of tax legislation with a proficient surveying process that captures costs that would generally go unnoticed. We’re looking forward to working alongside more clients to support them with their claims, from surveying assets through to claim submission.”

Holroyd added: “Capital allowances in the UK have never been as complicated or as generous as they currently are, and many businesses need specialist assistance to simplify and take advantage of this valuable relief.

“I am delighted to be joining a national business with an outstanding incentives and reliefs team and am excited about the opportunities this presents to both existing and new clients and the capital allowances team. I am looking forward to further developing the capital allowances offering within the Haines Watts network and working closely with other offices to provide market leading specialist advice to clients.”