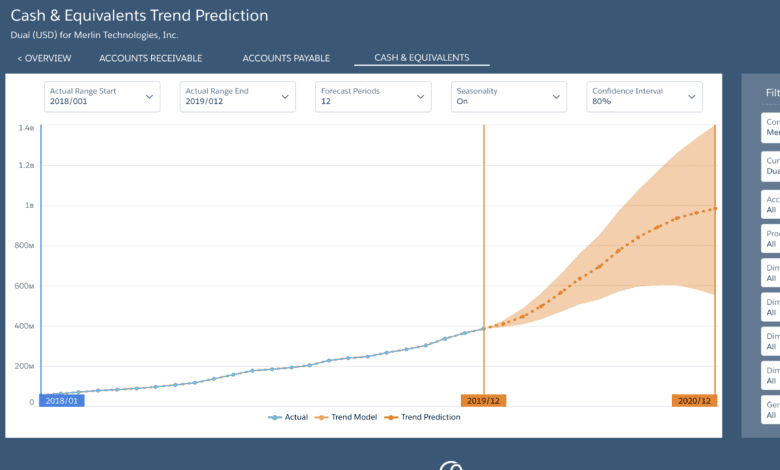

Cash flow is the foundation on which a successful business can be built. It keeps processes running, people employed and the lights on.You'll need to

subscribe to unlock this content. Already subscribed? Login?

Join 15,000 accountancy professionals with a membership

Get unlimited access and stay in the know. First-year special offer pricing. Cancel any time.

You have read 2/2 free articles this month.

Person

Monthly

Yearly

Save £9.89

No, thanks

I already have an account

Cash flow is the foundation on which a successful business can be built. It keeps processes running, people employed and the lights on.You'll need to

subscribe to unlock this content. Already subscribed? Login?